export finance consulting

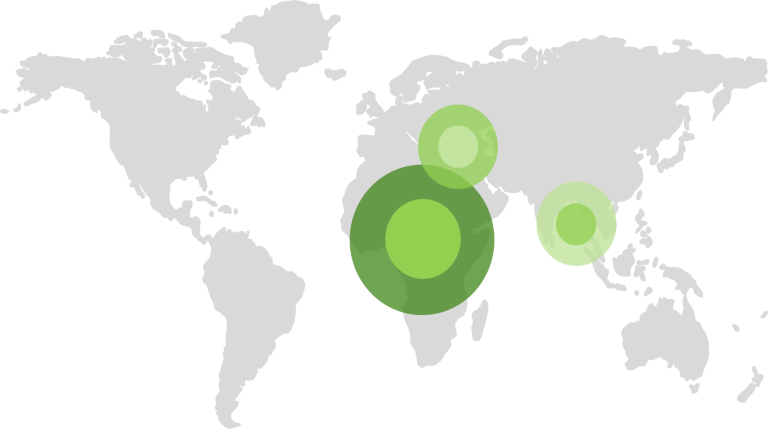

exficon offers expert consulting services and innovative financing schemes including the implementation of complex financing structures for export and project financings. The financial advisory firm based in Frankfurt am Main, Germany is specialized on transactions in emerging economies and developing countries with a strong focus on Africa. Since its incorporation in 2011, exficon’s team has achieved a coverage of 25+ countries across the African continent and other selected countries in South East Asia and the Caucasus region.

In particular small and medium-sized projects are often not “on the radar screen” of banks and financial institutions and require appropriate structuring to make them bankable. Properly tailoring projects to potential financers’ needs substantially facilitates the process leading to the successful conclusion of a financing. exficon supports the bankability of your project and prepares the information memorandum and the project documents in such a way so as to ensure the project’s appeal to potential lenders by conforming as closely as possible to their internal requirements. Finding a common understanding between banks or finance institutions and you, the customer, is of utmost importance.

export finance transactions

exficon’s clients are project developers, exporters or importers of goods and services. All of them are working on technically complex projects around the globe which require multi-country sourcing of equipment, know-how and implementation power. The sourcing composition will be a key aspect for the development of a professional financial concept commercially acceptable to financiers.

exficon develops the optimal financing structure for their clients and prepare tailor-made documents in order to obtain various bank financing offers for their projects. The greatest benefit here is complete cost transparency and advice independent from banks and financing institutions.

project finance transactions

exficon’s clients are international project developers working on technically complex projects around the globe – mainly in the infrastructure and (renewable) energy sector. The projects often require multi-country sourcing of equipment, know-how and implementation power. The sourcing composition will be a key aspect for the development of a professional financial concept commercially acceptable to financiers.